Maximizing Protection: What is Manufacturer Insurance and Why Do I Need It?

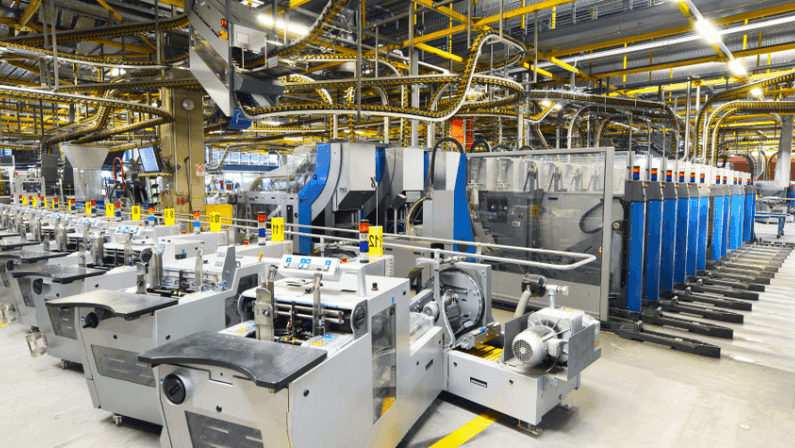

Running a manufacturing business involves a lot of moving parts–from operating heavy machinery to managing a large workforce. So, if you're in the manufacturing business, it's important to have the right protection for your company. Whether it's dealing with machinery breakdowns, employee safety, or unexpected disruptions, the right insurance coverage can be the lifeline your manufacturing business needs.

In this comprehensive guide, we will talk about the benefits and coverage of manufacturer insurance, highlighting the key risks in the manufacturing industry, the different types of insurance available, and how to choose a provider that best suits your business's unique needs.

Understanding the Importance of Manufacturer Insurance

Manufacturer insurance acts like a safety net. This type of insurance is specially designed to cover the unique risks that manufacturers face. For example, if a key piece of machinery suddenly breaks down, it could halt your production and lead to significant losses. Manufacturer insurance can help cover the costs of repairs or replacement, minimizing the downtime and financial impact on your business.

If an employee also gets injured on the job, manufacturer insurance can help cover their medical expenses and protect your business from potential legal issues. This not only supports your employees but also safeguards your business against unexpected financial burdens.

Manufacturer insurance can protect against external risks like natural disasters as well. These events can be devastating, but having the right insurance means your business can recover more quickly and with less financial strain.

Key Risks in the Manufacturing Industry

The manufacturing environment comes with potential hazards. Equipment failures not only disrupt production but also entail costly repairs. Accidents involving employees can result in significant compensation claims and legal fees. Supply chain issues can likewise lead to delays and lost revenue. In the absence of manufacturer insurance, these incidents can severely impact your business financially.

Here’s a closer look at some of the common threats and hazards that manufacturing businesses face:

Machinery Malfunctions

The backbone of any manufacturing business is its machinery. When these vital machines break down, not only does production grind to a halt, but the costs for repairs or replacements can be substantial. These unexpected expenses, coupled with the loss of production time, can create a significant financial strain.

Workplace Injuries

Manufacturing plants are often bustling environments where accidents can occur. Workplace injuries can lead to serious repercussions for both employees and employers. For the latter, this can mean facing hefty compensation claims and legal battles, which can be financially draining without proper insurance coverage.

Supply Chain Disruptions

A smooth-running supply chain is crucial in manufacturing. However, various factors like logistical delays, supplier issues, or even geopolitical factors can disrupt this chain. Such disruptions not only delay production but can also lead to lost revenue, strained customer relationships, and contractual penalties.

Costs Associated With These Risks

Without adequate manufacturer insurance, the financial burden of these risks can be overwhelming. From repair costs for damaged machinery to legal fees and compensation for workplace injuries and losses due to supply chain issues — the financial implications can be severe.

Types of Manufacturer Insurance Coverage

When you run a manufacturing business, it's important to have the right insurance to cover all aspects of your operations. Here's a breakdown of key types of insurance you should consider:

General Liability

This is a fundamental coverage that every manufacturer needs. It helps protect your business if someone gets hurt at your facility or if there's property damage. For instance, if a visitor slips and falls in your factory, this insurance can cover their medical bills and any legal fees.

Commercial Auto

If your business owns vehicles for deliveries or transport, you need this kind of insurance. It covers any damages or accidents involving your business vehicles. If one of your delivery trucks gets into an accident, this insurance can help pay for repairs or any legal issues that might arise.

Manufacturing Errors and Omissions

Mistakes can sometimes happen during the manufacturing process. This insurance is designed to protect against financial losses that occur due to these errors. For example, if a batch of products is manufactured incorrectly and causes a loss to your client, this insurance can help cover the costs.

Manufacturers Selling Price Insurance

Unlike typical policies that only cover the production cost, this insurance compensates you for the selling price of your damaged goods. It's beneficial in scenarios where the finished products are damaged, helping you recover the full potential revenue.

Product Recall Insurance

Recalls can be expensive, involving costs like notifying customers, shipping, and disposing of the recalled product. Product Recall Insurance helps cover these costs.

Factors To Consider When Determining Your Business’s Specific Insurance Requirements

When choosing manufacturer insurance, consider the nature of your goods, business size, and number of employees. Each factor plays a role in determining the specific coverage needed to protect your business adequately.

Selecting the right insurance for your manufacturing business isn't a one-size-fits-all process. There are several important factors to consider to ensure that you get coverage that fits your needs:

Nature of Your Products

What you manufacture plays a big role in the type of insurance you need. For example, if you're making high-value or hazardous products, you might need more comprehensive coverage. The risk of damage or accidents is different for electronics compared to clothing or food products.

Size of Your Business

The size of your operation also affects your insurance needs. A small, local manufacturer will have different risks and requirements compared to a large, multinational corporation. This affects not just the amount of coverage you need but also the types of risks you might face.

Number of Employees

The more employees you have, the more you might need to consider coverage like workers' compensation or liability insurance. Employee-related risks increase with the number of people working for you, so make sure that your insurance reflects that.

Choosing the Right Manufacturer Insurance Provider

Choosing the right insurance provider is as important as selecting the insurance itself. If you’re not sure where to start, here are some key points to consider:

Industry Understanding

Choose a provider that knows the ins and outs of the manufacturing industry. They should be familiar with the specific challenges and risks unique to your field. This knowledge ensures they can offer insurance solutions that are relevant and effective for your business.

Tailored Solutions

The best insurance provider for you is one that doesn't just offer generic policies, but rather provides tailored solutions. They should be able to customize their offerings to fit your business's specific needs, whether it's related to the type of products you make, your business size, or your operational scope.

Comprehensive Coverage Options

Look for a provider that offers a wide range of coverage options. This variety means you can get all the protection you need from a single source. It's convenient and ensures that there are no gaps in your coverage.

Expert Guidance

Besides selling you policies that fit your business, a good insurance provider should also help you understand them. Look for an insurance partner who can answer any of your questions about the insurance policy that you are considering for your business.

Secure Your Manufacturing Business with Hotchkiss Insurance

If you're running a manufacturing business, picking the right insurance is really important. Hotchkiss Insurance is here to make that easier for you. We've got the expertise and experience to help you find the insurance that fits your business perfectly.

With locations in Houston, Dallas, San Antonio, Fort Worth, and Lubbock, we're well-equipped to serve manufacturers across Texas with insurance solutions. Whether it's covering your machinery, protecting against liability, or ensuring your employees' safety, we're here to provide comprehensive coverage that gives you peace of mind. Contact us today to learn more about insurance for manufacturing companies.