Navigating Equipment Breakdown Coverage: Essential Protection for Your Business

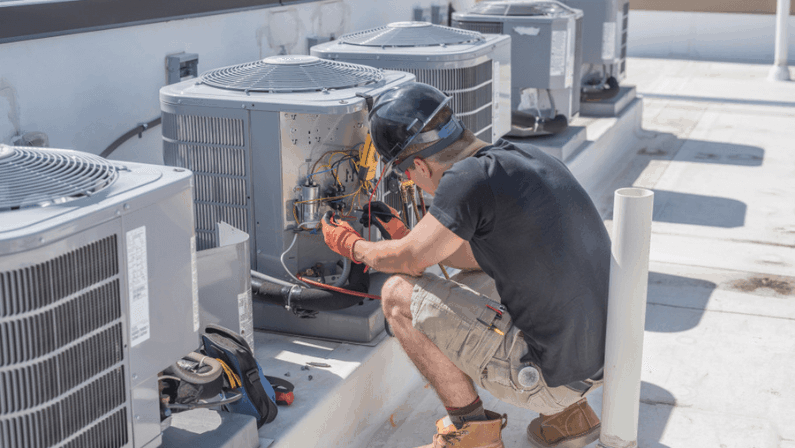

Relying on various mechanical, electrical, and electronic equipment has become the norm. From manufacturing machinery to office air conditioning systems, technology plays a vital role in ensuring smooth operations.

However, when this equipment fails, it can lead to not just operational downtime but also significant financial losses. This is where equipment breakdown coverage becomes crucial.

In this guide, we will go into what equipment breakdown coverage entails, its benefits, and the scope of protection it offers to businesses.

What Is Equipment Breakdown Coverage?

Equipment breakdown coverage, often referred to as boiler and machinery insurance, is a policy designed to protect businesses from the financial impact of damaged or malfunctioning equipment.

It fills the gap left by standard commercial property insurance, which typically does not cover losses related to equipment failure unless it's caused by external factors like fire or natural disasters. Equipment breakdown insurance goes further, covering losses resulting from internal forces such as motor burnout, operator error, and mechanical breakdown.

This type of insurance is pivotal for businesses that heavily depend on machines and equipment for their daily operations. It not only covers the cost of repairing or replacing the damaged equipment but also covers the losses incurred during the downtime caused by equipment failure.

How Can Equipment Breakdown Insurance Protect Your Business?

The tangible protection equipment breakdown insurance offers extends beyond simple repair or replacement coverage. It safeguards your business against a range of financial risks and ensures continuity in the face of unexpected equipment failures. Here are several ways it can protect your business:

Business Continuity: Helps minimize downtime by covering the costs of temporary equipment or speeding up the repair/replacement process, ensuring your operations can resume quickly.

Financial Security: Provides coverage for lost income and extra expenses incurred during the downtime, helping your business stay financially stable.

Risk Management: Acts as a critical component of a comprehensive risk management strategy, protecting against the unpredictability of equipment failure.

Compliance and Safety: In some cases, it also covers the costs associated with equipment inspections and safety certifications, ensuring compliance with industry regulations.

What Does Equipment Breakdown Cover?

The extent of coverage can vary depending on the policy and provider, but most equipment breakdown insurance policies offer wide-ranging protection, including:

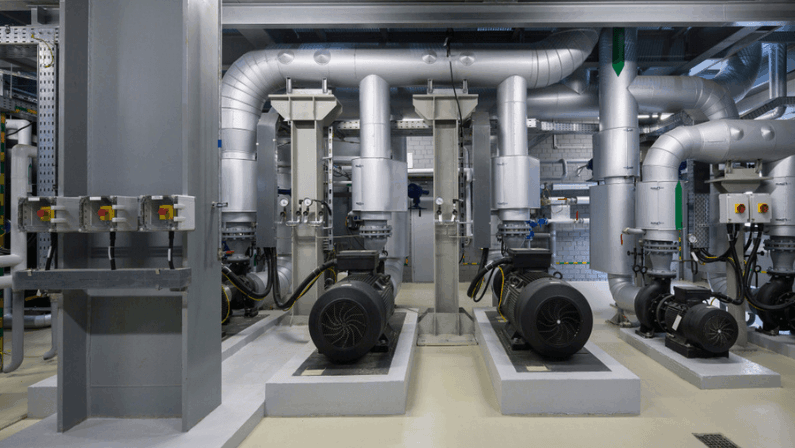

Mechanical Breakdown: Covers physical damage to equipment caused by mechanical issues such as motor failure or pump breakdown.

Electrical Breakdown: Protects against damage from electrical causes like power surges, short circuits, or motor burnouts.

Air Conditioning and Refrigeration Breakdown: Offers coverage for losses stemming from the breakdown of HVAC systems and refrigeration units.

Boiler and Pressure Vessel Breakdown: Provides protection against damage from the sudden and accidental breakdown of boilers and pressure vessels.

Business Income and Extra Expense: Covers the loss of income and additional expenses incurred while your equipment is being repaired or replaced.

Understanding more about equipment breakdown coverage and ensuring your policy matches your business’s specific needs can be pivotal in mitigating operational risks. It is an essential aspect of a strategic approach to safeguarding your business’s future, assets, and peace of mind.

What Is Not Covered by Equipment Breakdown Insurance?

While equipment breakdown insurance provides extensive coverage against various mechanical, electrical, and operational failures, it's essential to understand its limitations. Generally, this type of insurance does not cover:

Wear and Tear: Gradual deterioration or losses due to normal wear and tear over time.

Software Issues: Problems related to software, data losses, or cyber attacks.

External Causes: Damage caused by external events such as natural disasters, vandalism, or theft is typically not covered, as these are usually addressed by commercial property or specialized insurance policies.

Maintenance-Related Failures: Breakdowns due to lack of maintenance or servicing are often excluded, underscoring the importance of regular equipment upkeep.

Who Should Buy Equipment Breakdown Insurance?

Any business that relies on mechanical, electrical, or electronic equipment for daily operations should consider purchasing equipment breakdown insurance. This includes:

Manufacturing Businesses: High dependency on machinery and production equipment.

Service Providers: Use of specialized equipment in services like printing, healthcare, and auto repair.

Food Services: Dependence on cooking, refrigeration, and HVAC systems.

Retail Businesses: Need for operational technology like computers, security systems, and air conditioning.

Offices: Use of IT equipment, servers, and air conditioning which are crucial for operations.

Essentially, if the sudden breakdown of equipment could lead to significant financial loss or operational disruption, equipment breakdown insurance is a prudent investment.

Examples of Equipment Breakdown Coverage for Business

Before diving into examples, it’s crucial to understand that equipment breakdown insurance is designed to help businesses manage the unexpected costs and disruptions following the malfunctioning of essential equipment. Here are three examples illustrating how this coverage provides protection:

Manufacturing Firm: A key piece of assembly line machinery suddenly malfunctions due to an electrical short circuit. Equipment breakdown insurance covers the repair costs and replaces the lost production income during downtime.

Restaurant: The cooling system of a walk-in freezer fails overnight, spoiling thousands of dollars worth of food. The policy not only covers the cost of repairing the freezer but also reimburses for the spoiled inventory.

Data Center: A significant surge damages servers and cooling systems, halting operations. The insurance helps cover the repair/replacement of the damaged hardware and compensates for the business interruption costs.

These scenarios underscore the broad utility of equipment breakdown insurance, highlighting its importance across various industries.

How Do You Get Equipment Breakdown Insurance?

Obtaining equipment breakdown insurance is a straightforward process but requires due diligence to ensure your business gets the right coverage:

Assess Your Needs: Evaluate the equipment crucial to your business operations and potential financial risks if they were to suddenly break down.

Consult with Insurance Professionals: Speak with an insurance agent or broker experienced in business coverages. They can help assess your risks and recommend the right level and type of coverage.

Get Quotes: Request quotes from several insurance companies to compare coverage options and premiums. Pay close attention to coverage limits, deductibles, and exclusions.

Review and Purchase: Carefully review each policy offering with your agent to understand the coverage details fully. Once satisfied, proceed to purchase the insurance.

Remember, the goal is not just to buy insurance but to invest in your business's resilience. Taking the time to get the right coverage could make all the difference when unexpected equipment breakdowns occur.

How Much Does Equipment Breakdown Insurance Cost?

The cost of equipment breakdown insurance varies significantly based on several factors, including the type of business, the value and nature of the equipment covered, and the risk level associated with the business operations. Other determinants include the coverage limits chosen and the deductible amount.

Smaller businesses employing less complex and lower-value equipment might expect to pay a few hundred dollars annually for coverage. In contrast, larger operations with higher-value, specialized machinery could see premiums in the thousands. It is crucial for businesses to work with their insurance provider to get an accurate quote tailored to their specific needs and risk exposures.

Is Equipment Breakdown Coverage Right for My Business?

Deciding whether equipment breakdown coverage is right for your business involves assessing your reliance on equipment for daily operations and understanding the financial implications if key machinery were to suddenly fail. Consider the following:

Operational Dependency: If your business operations heavily rely on machinery, computing equipment, or electronic systems, this coverage can be indispensable.

Financial Impact: Evaluate the potential loss of income and added expenses (like equipment rental) you’d face during downtime. If these costs are significant, insurance can provide a financial safety net.

Industry Considerations: Certain industries are more prone to equipment breakdown risks. If you’re in manufacturing, food services, information technology, or any sector where equipment plays a pivotal role, it’s wise to consider protection.

Ultimately, if the sudden malfunction or breakdown of equipment could jeopardize your business operations, obtaining equipment breakdown insurance should be strongly considered.

Get Equipment Breakdown Insurance Quotes From Hotchkiss Insurance Today!

As a leading insurance agency in Texas, Hotchkiss Insurance specializes in providing comprehensive business insurance coverage tailored to various professionals and industries. Whether you're a home builder, independent trade contractor, general contractor, restaurant owner, or involved in commercial construction, Hotchkiss Insurance has the expertise and solutions tailored to your specific needs.

Our team of experienced professionals understands the unique challenges and risks associated with different sectors. We’re committed to helping you safeguard your business against unforeseen equipment breakdowns, ensuring that your operations can continue smoothly, no matter what challenges arise.

At Hotchkiss Insurance, we take pride in offering personalized service and competitive quotes for equipment breakdown insurance. We work closely with you to assess your specific needs, ensuring that you receive coverage that provides optimal protection for your valuable machinery and equipment.

Don’t let unexpected equipment failures disrupt your business. Connect with Hotchkiss Insurance today, and let us provide you with a tailored insurance solution designed to protect your assets and ensure your peace of mind. Visit us at our locations at Houston, Dallas, San Antonio, and Fort Worth, TX, or browse our website or contact us directly to get your equipment breakdown insurance quote and learn more about how we can support your business’s unique requirements.